Understanding Nexus in NetSuite

Nexus in NetSuite refers to the connection between a business and a particular taxing jurisdiction, typically a state or a country. It determines the obligation of a business to collect and remit sales tax based on its activities within that jurisdiction. It is crucial for businesses to accurately set up and manage their nexus in NetSuite to ensure compliance with tax regulations.

Check for the existing Nexus or create a new one: Setup > Accounting > Nexuses

The Significance of Nexus on Transactions

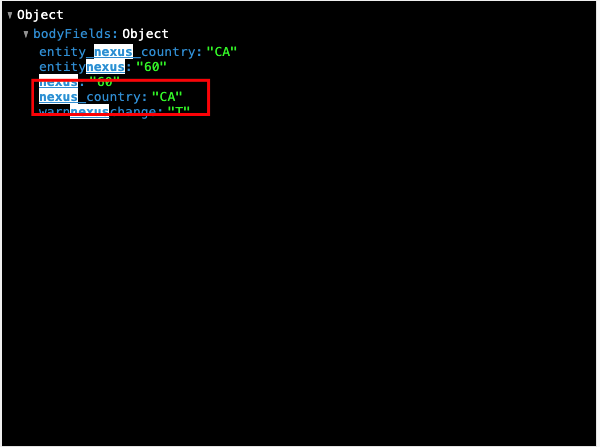

Nexus plays a pivotal role in NetSuite transactions, especially when it comes to determining the applicable tax rates.

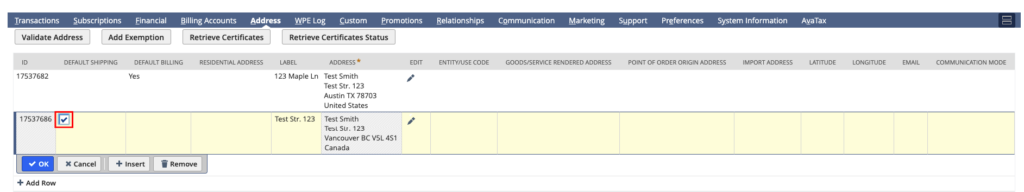

The country nexus is primarily established through the entity’s shipping address rather than the transaction’s address or entity’s billing address.

This distinction is vital for businesses to ensure that they are applying the correct tax rules to their transactions. To check the right shipping address checkbox for the customer: Lists > Relationships > Customers > Address (only available in edit mode)

Changing Nexus in NetSuite

In certain situations, businesses may need to change their nexus settings in NetSuite. This could be due to changes in business operations, expansion into new territories, or other strategic reasons. To modify the nexus in NetSuite, businesses should navigate to the appropriate settings within the system. It is crucial to update the shipping addresses associated with customers accordingly. Timely and accurate updates ensure that the system reflects the current nexus status, facilitating compliance with tax regulations in the jurisdictions where the business operates.

Conclusion: Putting the Address in Focus

In the realm of NetSuite and tax compliance, one key takeaway stands tall — the shipping address reigns supreme in determining country nexus. Accuracy in nexus setup hinges on meticulous attention to shipping details. By recognizing the paramount importance of the shipping address, businesses can navigate tax complexities in NetSuite with precision, ensuring compliance and financial operations that stand on a solid foundation.